11597 12002c struck out at end A similar rule shall apply in the case of the minimum tax credit under section. It was held that the term interest is defined under Section 228A of the Income-tax Act.

State Income Tax Collection Per Capital Income Tax Income Tax

115141 struck out at end The preceding sentence shall apply only in the case of a corporation treated as an S corporation by reason of an election made on or after March 31 1988.

. Under Section 127 of the Internal Revenue Code IRC employers are allowed to provide tax-free payments of up to 5250 per year to eligible employees for qualified educational expenses. As laid down in the Notification No. 97248 effective as if such amendment had been originally included as part of this section as this section was amended by the Omnibus Budget Reconciliation Act of 1981 Pub.

Post getting clearance for Tax exemption. C agency contract means a contract between an insurance agent and an insurer in which the insurance agent agrees to act as an insurance agent in respect of insurance issued by the insurer but does not include the arrangement that an insurance agent has with. A benefit an employer provides on behalf of an employee is taxable to the employee even if.

Aggrieved by that order the Assessee filed an appeal which came to be allowed by the Commissioner of Income Tax Appeals - IV Kanpur on 20122016. For provisions that nothing in amendment by Pub. Not Your Fathers Catalog Music Streaming has made catalog music more important than ever - but the catalog thats growing isnt necessarily what youd expect.

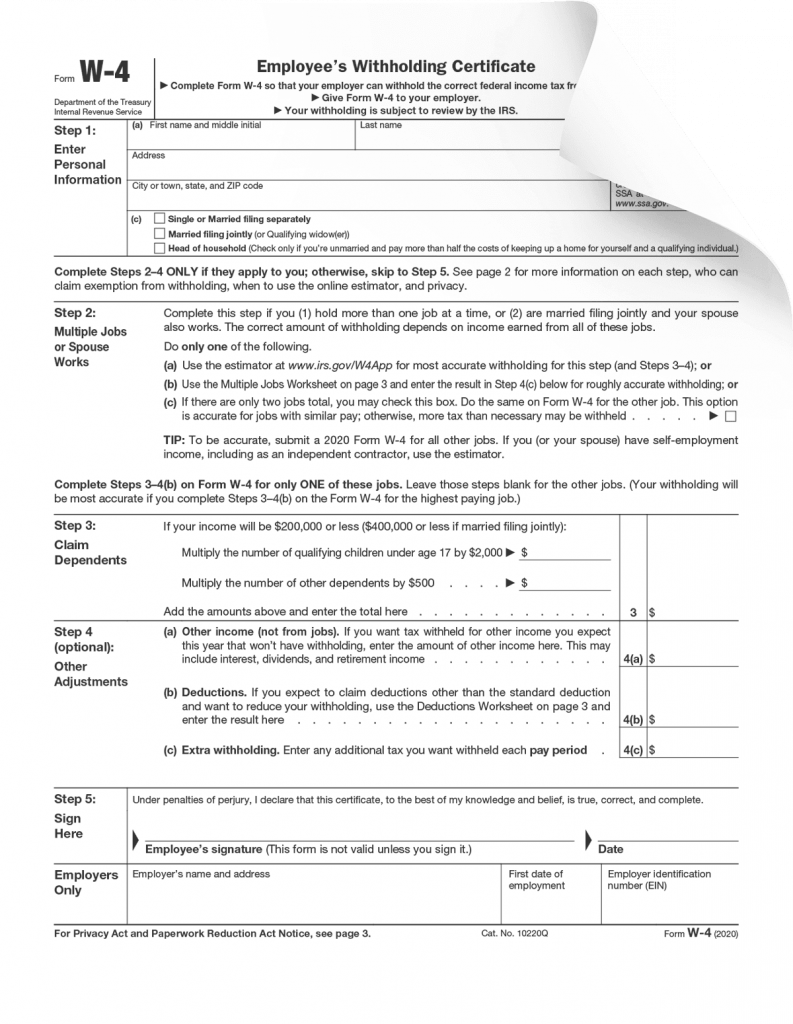

115141 be construed to affect treatment of certain transactions occurring property acquired or items of income loss deduction or credit taken into account prior to Mar. 1 - Short Title 2 - PART I - Income Tax 2 - DIVISION A - Liability for Tax 3 - DIVISION B - Computation of Income 3 - Basic Rules 5 - SUBDIVISION A - Income or Loss from an Office or Employment 5 - Basic Rules 6 - Inclusions 8 - Deductions 9 - SUBDIVISION B - Income or Loss from a Business or Property 9 - Basic Rules. Conjunction with the methods in either Section 1 or Section 1 Withholding Methods for Forms W-4 Section 2 whichever applies.

From such definition it appears that the term interest has been made entirely relatable to money borrowed or debt incurred and various gradations of rights and obligations arising. 97248 set out as a note under section 1395x of Title 42 The Public Health and. B affiliate has the meaning set out in section 3.

Wages paid to a Minnesota or Montana resident that are exempt from North Dakota income tax under. List of sections or provisions. When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you.

As per section 140A1 any tax due after allowing credit for TDS advance tax etc along with interest and fee should be paid before filing the return of income. 127 E dated 19022019 issued by Department for Promotion of Industry and Internal Trade DPIITthe following will be considered as a Startup -. 127 Bismarck ND 58505-0599 Walk-in service State Capitol 8th Floor.

A adjuster has the meaning set out in section 2. Following is the complete sections of the Income Tax Ordinance 2001 updated up to June 30 2001 after incorporating changes brought through. Added by Acts 2003 78th Leg ch.

Amendment by section 128b of Pub. Get all the latest India news ipo bse business news commodity only on Moneycontrol. 23 2018 for purposes of determining liability for tax for periods ending after Mar.

Applicability to nonresident corporations and discussed in relation to. Federal laws of Canada. Code title 49 sections 11502 rail carrier 40116f2 air carrier 14503a motor carrier and 14503b2 water carrier.

23 2018 see section 401e of Pub. The gasoline tax rate is 20 cents for each net gallon or fractional part on which the tax is imposed under Section 162101. HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and.

2 federal income tax based on the tax rate for a single person claiming one personal exemption and the standard deduction. For example education expenses up to 5250 may be excluded from tax under IRC Section 127. Post getting recognition a Startup may apply for Tax exemption under section 80 IAC of the Income Tax Act.

How to make appeal before commissioner IR. Amounts for additional education expenses exceeding 5250 may be excluded from tax under IRC Section 132d. More than one IRC section may apply to the same benefit.

In view of the above transfer under Section 127 the Deputy Commissioner of Income Tax Central Circle Ghaziabad proceeded further and passed an assessment order on 31032015. An additional refundable tax of 10 23 is levied on the investment income other than deductible dividends of a CCPC. The credit generally applies only to taxes of a nature similar to the tax being reduced by the credit.

3 state income tax. Ensure you request for assistant if you cant find the section. North Dakota Income Tax Withholding Rates and Instructions 2022 Calendar Year 2022 NORTH DAKOTA.

Personal property of nonresidents as a general rule not taxable. Section is merely directory. In case you additional materials for your assignment you will be directed to manage my orders section where you can upload them.

5 expenses for the cost of health insurance dental insurance or cash medical support for the obligors child ordered by the court under Sections 154182 and 1541825. This additional tax may be part of the refundable portion of Part I tax on line 450 and would be added to the refundable dividend tax on hand RDTOH or for tax years starting after 2018 to the. A foreign tax credit FTC is generally offered by income tax systems that tax residents on worldwide income to mitigate the potential for double taxationThe credit may also be granted in those systems taxing residents on income that may have been taxed in another jurisdiction.

9735 see section 128e2 of Pub. To be considered qualified payments must be made in accordance with an employers written educational assistance plan. From state income tax or state income tax withholding under federal interstate commerce law.

Line 604 Refundable tax on CCPCs investment income. C for the purposes of applying sections 37 65 to 664 667 111 and 126 subsections 1275 to 36 and section 1273 to the person the person is deemed to be a new corporation or trust as the case may be the first taxation year of which began at. 12-71 re personal property subject to tax.

Income tax law describes apportionment of deductions. Income tax calculation on fair market value. As per section 140A3 if a person fails to pay either wholly or partly self-assessment tax.

Income Tax Case Laws Section Wise containing decisions of Supreme Court High Court Tribaul CESTAT CEGAT AAR Advance Ruling Authority etc. Tax paid as per section 140A1 is called self-assessment tax.

How To File A Zero Income Tax Return 11 Steps With Pictures

10 Proof Of Income Documents Landlords Use To Verify Income

Fun Activities For Teaching Teens Financial Literacy Financial Literacy Teaching Teens Teaching

How To File A Zero Income Tax Return 11 Steps With Pictures

No Capital Gain If Development Got Cancelled And Possession Taken Back

What You Need To Know About Proof Of Income Form Pros

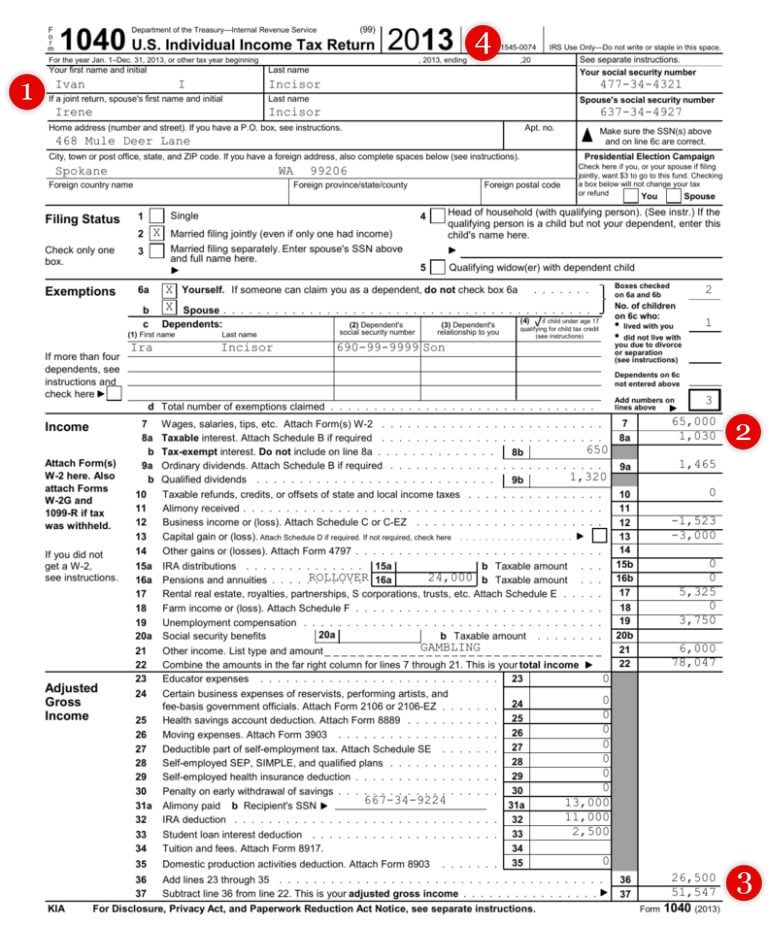

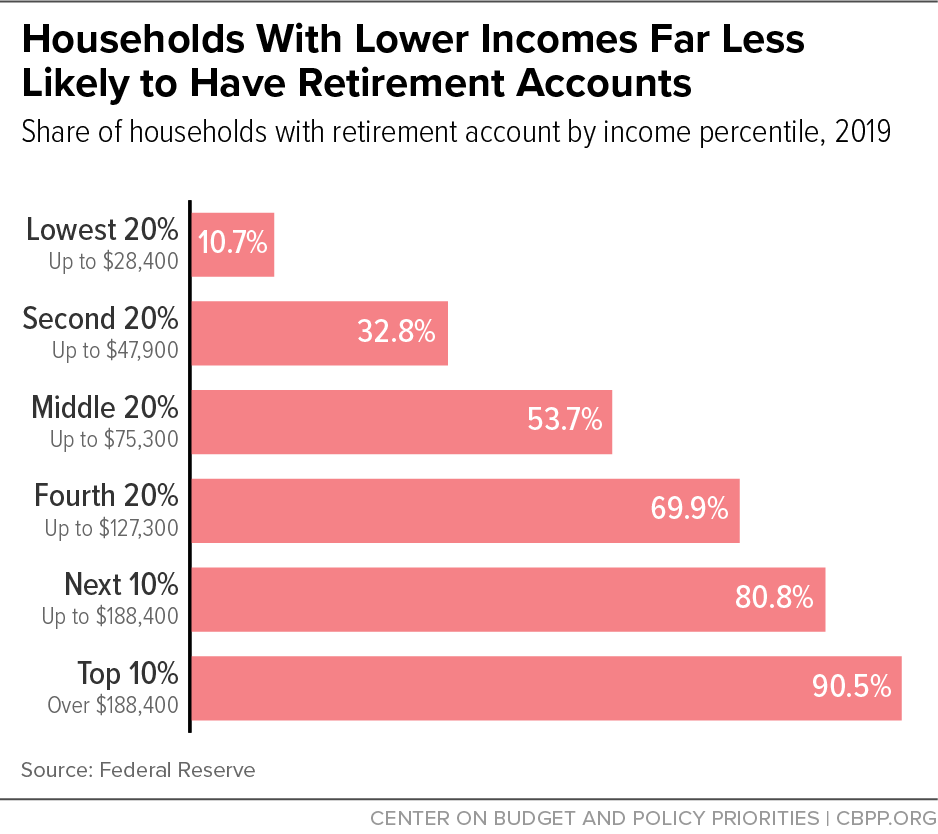

House Bill Would Further Skew Benefits Of Tax Favored Retirement Accounts Center On Budget And Policy Priorities

What You Need To Know About Proof Of Income Form Pros

Infographics Infographic Design By Column Five Tax Day Infographic Income Tax

Tax Delinquent Property And Land Sales Alabama Department Of Revenue In 2022 Scholarships Guidance Acting

Pin By Jammalamadaka Venkata Subrahma On Jvsubrahmanyambcom24275 Income Tax Return Tax Return Income Tax

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live Salary Life Money Hacks Smart Money

Pin On Bankruptcy Infographics

H R Block Tax Return Australia Sydney Branding Poster Design Graphic Illustratio Book And Magazine Design Identity Design Logo Social Media Design Inspiration

The States With The Highest Corporate Income Tax Collections Per Capita Are New Hampshire Massachusetts California Alaska And Delawar Income Tax Tax Income

Clarification Regarding Gst Rate On Laterals Parts Of Sprinklers Or Drip Irrigation System Drip Irrigation System Irrigation System Irrigation

From 1993 To 2012 Median Family Income Rose 7 While Tuition Has Gone Up 120 Family Income Tuition Job Hunting

Financial Statement Templates 13 Free Word Excel Pdf Financial Statement Statement Template Financial Position